As investors in the cannabis industry, we get asked by entrepreneurs about what options they have when looking for funding and how, if at all, those options differ because of that whole federally illegal, brand-new industry thing.

Watch a recent webinar presentation on an overview of who is investing in cannabis

The first thing to know is that there are, in fact, some differences in this industry but they relate more to the novelty of the industry than to its current status. Because cannabis is a young legal sector, a lot of the forms of funding in more established industries are less common...like bank loans and lines of credit.

To help you get a better idea of your options as an entrepreneur, we’ve broken down four different types of funding sources and how each one relates to this nascent industry.

Crowdfunding

You can always opt for a crowdfunding route, which is when a company takes cash from individuals in exchange for some kind of perk- be it first access to the product, a chance to help design the product or even a small amount of equity. There are many pros and cons of this type of funding, but the important thing to note here is that the people offering funding in this case are regular people who are interested in your business. Therefore, it can be not only a good source of cash, but also a good way to increase exposure. Tread carefully, though, as being part of the cannabis industry complicates it.

However, not all crowdfunding sites are accepting cannabis businesses. The ones to look toward are Republic, SeedInvest and Microventures, where some of our teams have raised between $100k and $1M.

Angel Investors

Along with Venture Capital, this is the most common form of equity funding in the cannabis space. Angel investors are high net-worth individuals who are interested in making private investments into promising companies.

Sometimes Angels invest alone as individuals and sometimes they invest as part of a group or syndicate, often facilitated by an organization like The Arcview Group, which is the largest angel group in the cannabis industry. Angel groups are all structured a little differently but the main thing to know with Angel groups is that they’re built around finding and sorting through deals and, ultimately, funding some of them.

Angels can move fast, and take risks that other investors may not be comfortable with, which is probably part of the reason they’re called “angels” - they might just lift you up when you need it most.

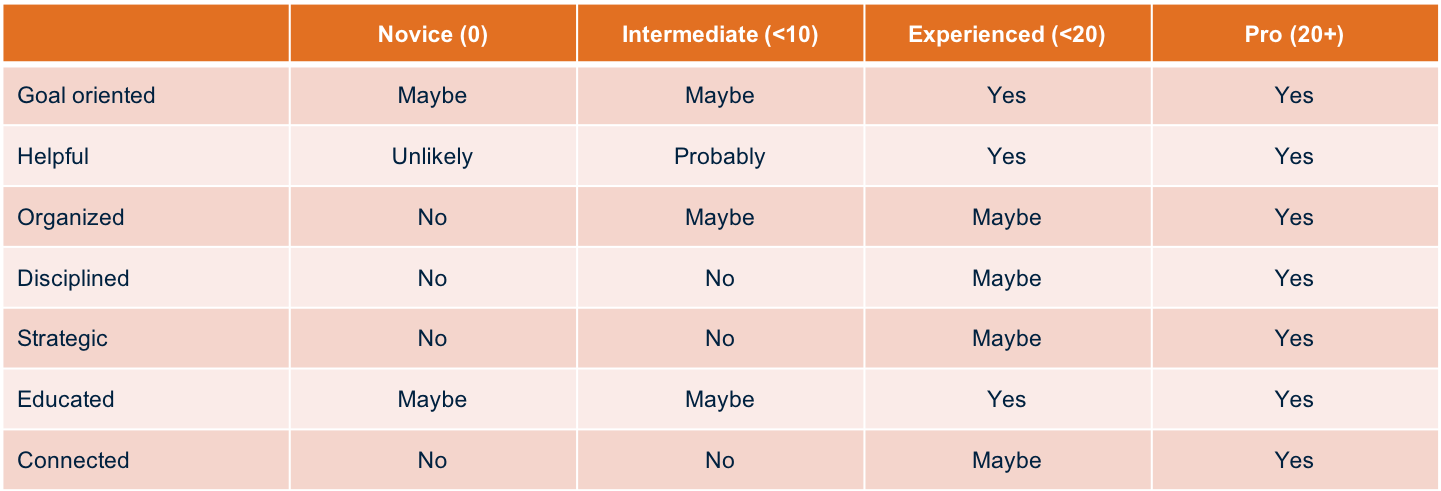

Regardless of where you find them, there are many of these investors out there - some more organized, disciplined and experienced than others. As an entrepreneur, you need to know what to look for in order to determine who they are and how much time you should (or should not) spend with them.

Below is a chart which will help you get an idea of Angels and how their questions and goals can help you identify their level of familiarity with the space.

Family Offices

Family Offices manage the wealthy accumulated by families. Family Offices are run by professional investors hired and paid by the “family” to review deal flow, make investment recommendations, and fund deals on their behalf. Warning - family offices can be conservative and move slowly with their investment decisions, so prepare to be patient and understand someone in the family might simply nix the investment because it is cannabis. Family politics and drama can come into play here, but a good family office manager will help mitigate this.

Funds

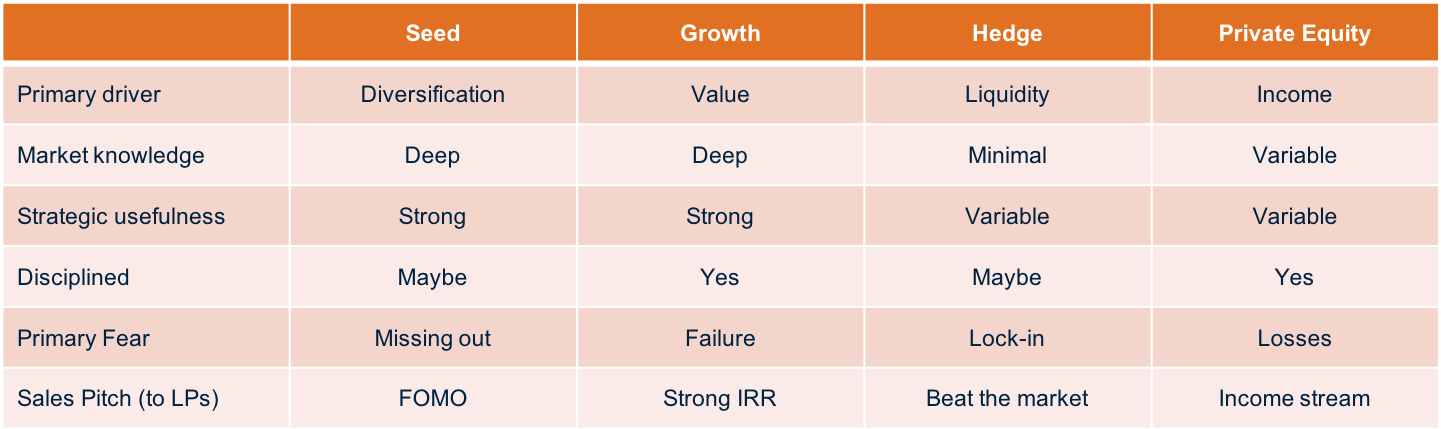

There are quite a few different types of funds out there and each fund likely has different goals and preferences on where, when, and how to invest. As an entrepreneur in charge of fundraising, it is your responsibility to become an expert on all the funds actively investing in your sector.

However, the trends we've been seeing is that venture funds are responding to the maturation of the industry, preferring to invest in companies with proven product-market fit and traction. Many look to make Series A investments into companies with an MRR of $30k and up.

Below is a breakdown of some of the different types of funds and their goals.

Venture Capital Funds

Also common in the cannabis industry (along with Angel Investors) are seed- and growth-stage Venture Capital Funds, best fit for serving an emerging market. These funds’ goals are to invest into a company at a valuation (sometimes at a discount) and achieve outsized returns down the road. Most of these funds are looking for a 10x return on invested capital within a 10 year timeline as a result of an exit of some sort - IPO, merger or acquisition. That’s why it is not surprising how many venture capital funds have launched in the cannabis industry in the last 5 years. However, a word of caution: beware of the “vapor” fund - a fund in website and press-release only. There are many vapor funds in the cannabis industry. They are vapor funds because they have no capital in the bank to invest. Either they are in the process of raising their fund OR they plan to negotiate a deal with you and then go out to raise the capital in what some people refer to as “call-down-funds”. Do not be afraid to ask if the VC fund has the money to meet their end of the bargain when the docs are signed… not after they go out to their investors to raise capital to fund the deal.

Hedge Funds

In addition to venture capital, we have seen the development of hedge funds in the cannabis industry - especially with the elevated importance of public markets. Hedge funds are focused on creating quick liquidity (i.e. a quick return on their investment) more so than venture capital funds.

It is not uncommon for a hedge fund to invest in a private company with the expressed plan to take them public. Often this exact scenario will be spelled out in their investment documents or amended to the company’s operating agreement to ensure penalties to the company if they do not execute this plan. Again, entrepreneur beware.

That being said, hedge funds are often run by experienced investors - more experienced in finance than you - so they can quite simply make you wealthy beyond your wildest dreams. They can also destroy your company, though.

Private Equity Funds

Private equity funds are quite different than angels, hedge funds, vc funds and family offices. Private Equity funding usually sees the owners cede control of the company to the PE firm through board representation or share ownership. While founders may maintain some stake going forward, Private Equity funding often results in an entirely new management and ownership structure.

As traditional private equity is a later-stage investment model, it has been relatively uncommon in the cannabis industry thus far – mostly due to the small size and lack of large companies currently in the industry. We expect to see more private equity style investments in the cannabis industry in the next 3-5 years, as the industry matures.

Public Markets

An Initial Public Offering (IPO) is a common form of funding for start-ups. Currently, only a handful of companies have chosen this option in the US. However, Canada has seen significantly more movement in this area due to the progressive federal stance on cannabis in Canada. Typically, going public is not a great option for startups, but in the cannabis industry it has become relatively popular, and lucrative, method for raising capital. Why? One word - liquidity. Investors and owners can access liquidity for their shares through a public offering, reverse merger, or other mechanism to go public. Outside the cannabis industry, the trend is just the opposite with privately held “unicorns” staying private longer and longer with the help of mega-funds and sovereign-wealth funds investing 9-figure sums into 11 and 12-figure valuations. In fact, the number of public companies in the U.S. currently is shrinking.

Understanding the different forms of funding available to you and how each interact in the current cannabis industry will help your company choose the right path. So, be sure to think about your goals and timeline before choosing the best option for you.