So you’re starting a company. Hopefully, you’ve honed your idea, done the market research and assembled the right team. You’re on your way

But somewhere along the line, the question of fundraising always comes up - either as an infusion of cash for inputs or hiring or simply to pay your rent as you work full-time on your new venture. However, “funds” is such a large term - what kind do you need? When should you go looking for them? How much do you need? Where do you find them? Well, we got you covered.

To start thinking about fundraising, first answer the following questions:

- What are your goals? Do you want a stable income and a nice life for you and a few employees or are you driving toward a large exit or IPO down the road?

- At what fundraising phase is your business currently?

- What do you actually need to get started? What’s your cost of expansion?

Goals

Depending on the goal of your organization, the type, amount and timing of your funding will vary. Most start-up businesses are what we refer to as lifestyle businesses, meaning that they offer founders and a few employees stability and a good source of income. They are not usually experiencing rapid growth, expanding into new areas and creating great value. However, on the other side, there are businesses expanding rapidly and driving toward multi-million dollar exits or IPOs. Depending on which you are, funding will look different.

For lifestyle businesses, it probably doesn’t make sense to bring on equity funding because usually all these businesses need is some working capital to cover expenses and get started. And why give up part of your company if you don’t need to? Instead, lifestyle businesses should consider short-term debt which can provide the cash infusion needed for getting your business up off the ground.

For rapid growth businesses driving toward exits, equity investment is more common. It allows businesses to access large amounts of cash without adding debt as well as a financial partner who can be an asset in guiding the company and obtaining future investment.

Timing is everything

So, you know your driving toward rapid expansion and a large exit - but when are you ready to raise capital? And what kind should you be looking for?

To answer these questions, you need to understand where you are in your business, what you’ve accomplished and what value you’ve created in order to know what to call your fundraise and who to look for as a partner.

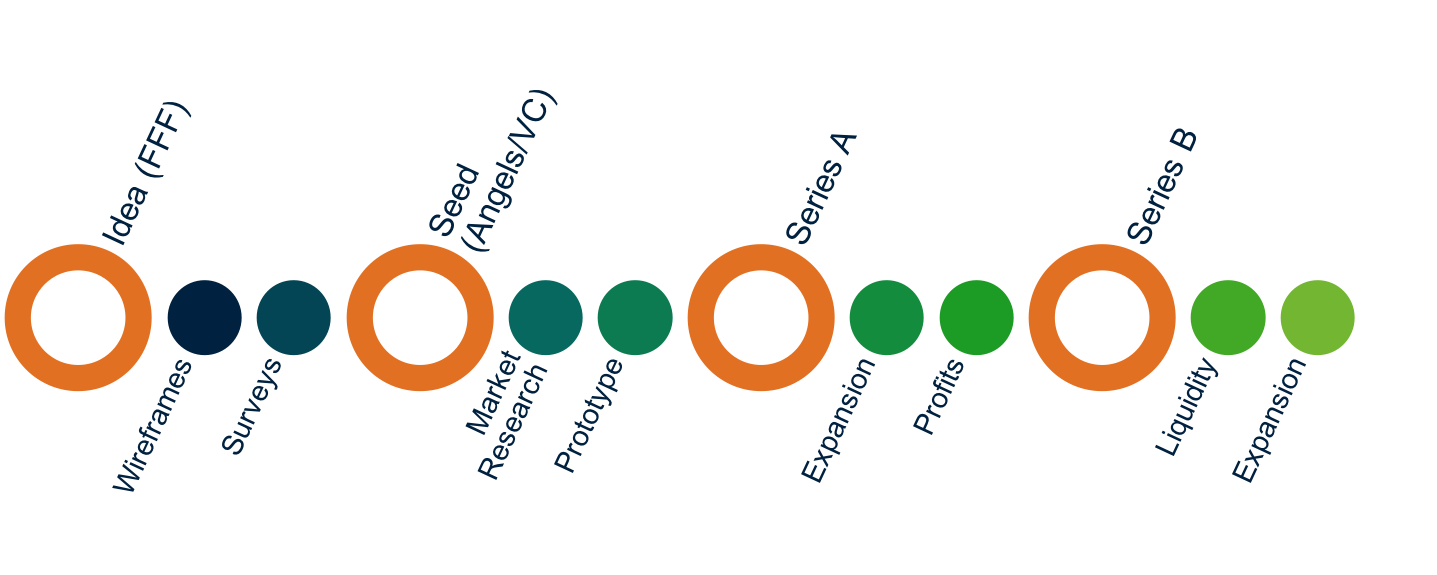

Below is a guideline we share with our teams to help them understand where they are in their own business and determine where they fit into the fundraising process.

Idea phase

This is the phase when you’re gathering data about your market and beginning to build out a minimum viable product. Companies at this phase haven’t created much value yet, making it riskier for investors; inevitably, you’re going to give up more of your company either in equity or in the form of payments during this stage. During this time, funding really comes from your FFFs - family, friends and fools.

Seed phase

The seed phase happens for companies that have either completed a prototype or a market research study or are close to doing so. At this stage, you’ll be raising from Angel Investors and Venture Capital Funds primarily.

Series A

This phase comes about when your company has created significant value and the focus of the investment is on expansion and increasing profits.

Series B

Companies raise for Series B once they are established. The goals of investment at this phase are usually around generating liquidity or expanding further.

Determining how much you actually need

The general rule of thumb when fundraising is to ask for enough money to cover 18 months of operation. It might seem like a lot but investors want to know you’re asking for enough cash to make progress and get over the inevitable mistakes and obstacles you’re going to run into.

When thinking about how much your company needs, it’s also good to consider your plans. Take the case of MailChimp vs. Uber - Mailchimp first appeared in the mid-90s and has become a hugely successful company. However, when they began, their cost of expansion was quite low. Because of the way their business model was designed, they were able to easily move into new areas without investing large sums in new acquiring customers. This meant that they didn’t need large infusions of cash from investors.

Uber, on the other hand, has taken on massive amounts of investment since inception in 2009, mainly due to their growth plans. The company knew that the way to success was rapid penetration of markets, requiring them to move into multiple different physical markets at the same time. This required large amount of capital, hence the large investments.

So, ask yourself, what’s your cost of new customer acquisition? Is it something you can roll out slowly over time, or do you need to move quickly. This will help your business determine how much capital you need.

As a guide, we’ve created the following table based on our experience to help you think through where you fit and how much you should be raising. (disclaimer: This is a general average which can vary widely across businesses and verticals)