The term “startup” is really a pretty unhelpful one. What does it even mean? What counts as a startup? It’s a hard word because each business differs and things can escalate quickly. But, while all startups are different, there’s one thing they all have in common - a lot of risk.

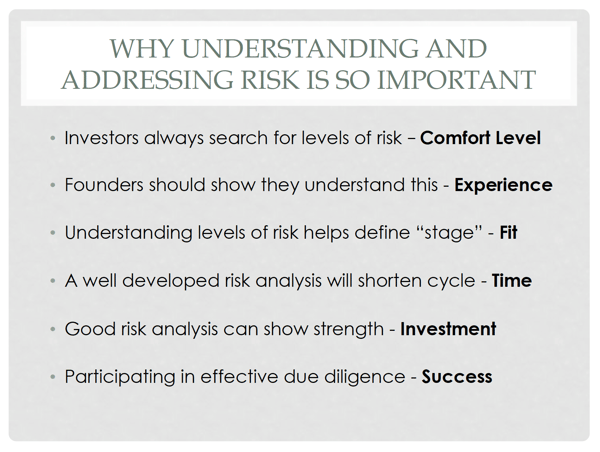

We’ve seen a lot of entrepreneurs and the one common thread in all the successful ones we know is their ability to identify and manage risk. It is a critical step not only for the entrepreneurs to do for themselves, but also because it signals a level of experience and control to investors.

Figure 1: why understanding risk is important

Figure 1: why understanding risk is important

For the entrepreneur, thinking through the different risks you will encounter at different stages in the development of your business is critical for timing your raise. Understanding how outstanding risk will affect your valuation and ability to obtain capital is key.

For the investor, businesses that have identified their risks and have plans in place for addressing them are better bets. While many startups get nervous at the idea of laying all their risks out to potential investors, it's better to do it early and be up-front. I mean, face it, any investor who is worth their salt is going to conduct due diligence and find these risks anyway. They’ll just be annoyed you weren’t up front from the beginning so, trust us, honesty is better than looking good.

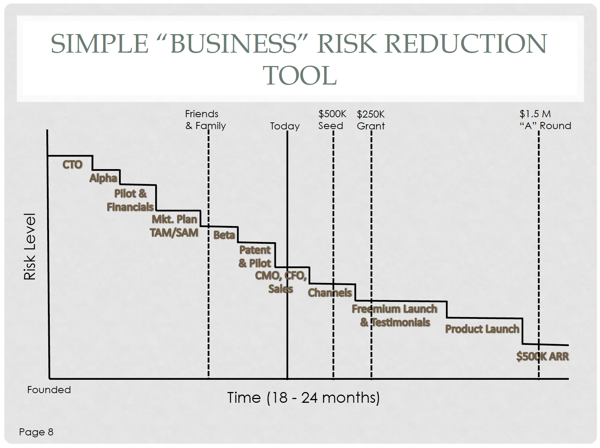

Figure 2: Sample risk chart

Figure 2: Sample risk chart

So, you know its important now but what areas should you be looking into? We always advise our entrepreneurs to use a risk chart (see figure 1). This chart is a simple one, placing level of risk against time and plotting all events against those. This chart should begin with the start of your business. While it's important to consider future risks, its often even more important to demonstrate what you’ve already accomplished. This shows investors that you’re not only in touch with your business, but you’re also proactive and have already overcome obstacles. Any area that investors look at during due diligence should be considered. Here are some of the top questions that you'll need to answer to be able to reduce risks and the ones we like to see on a risk reduction chart:

- Team - are you missing a co-founder? Do you have a tech product and no CTO? What is your Corporate Governance Structure? Make sure to add figuring all this out to your risk chart.

- Traction - when is the pilot? When do you move from beta to alpha? When do you close your first customer? These are important milestones to consider and present risks in their own right so be sure to plot them.

- Financials - How clean is your cap table? When do you cross the $10k/month in revenue line? How about the $500k annual revenue mark? It's important that investors see how your timeline works with revenue.

- Market - How big is it? How competitive is the market? Becoming the expert on your market is key to your success.

The other important element in a risk chart is when raises took place or will take place. Including events like your first family and friends raise and when you plan to raise a series A round are important to see plotted against milestones like traction, adding team members and revenues.

Get the full presentation here or listen to an episode of the CanopyBoulder Cannabis Business Podcast where we go into depth on thinking about risk for your startup: