Key Highlights:

-

Navigating potential cannabis deals is incredibly complex, time-consuming, and expensive

-

Investors with a data-driven deal flow methodology will yield higher returns with less time and money wasted on poor fits

-

Free tool to develop your data-driven investor thesis and streamline finding and evaluating deals.

Anyone not living under a rock these days is aware of the fast moving cannabis industry. What once was reserved for hippies and stoners is now a multi-billion dollar industry, growing at a compound annual rate of close to 30%. The nascent industry is often compared to other major booms like the gold rush, the oil boom or the dot com era.

Every week, there is more news showing the growing legitimacy and success of this industry- from bipartisan efforts in Congress to a 60% approval rating by the American public to the recent legalization of hemp under the Farm Bill. Regardless of your personal feelings about the plant, the evidence is clear that cannabis is here to stay. And there’s one guarantee that comes with that reality - an influx of investor interest.

However, a new industry certainly presents its challenges for investors. The novelty of this space means that even the most seasoned investors have to juggle a plethora of investment options, constantly changing regulations and evolving trends in literally brand new markets - something that turns into a full-time job (trust us, it’s our full-time job). Not to mention that, behind every innovative, game-changing startup, there are ten bad bets to avoid. We meet investors all the time who are finding it difficult to define a strategy, let alone create a pipeline that fits comfortably with that strategy.

In the past, we’ve tried to simplify that process by detailing the steps investors can take to make the best direct investments but even those steps are more qualitative than quantitative - leaving room for uncertainty.

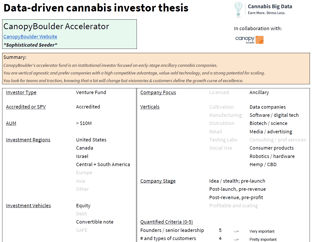

We know you don’t have time for that. That’s why we’ve partnered with CanopyBoulder alumni, Cannabis Big Data, to develop a free data-driven process which creates a custom-tailored investor profile and deal analyzer to simplify the process of finding and evaluating deals.

Here’s how it works:

-

Investors take 3 minutes to fill out 3 sections (~18 questions)

-

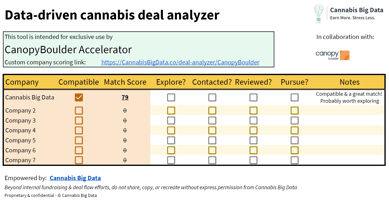

We transform those answers into a one-page investor thesis + one-page deal analyzer

-

Investors invite potential investments to fill out their own founder data-driven business profile and/or opt-in to receive news, events, and deals when relevant to your specific investment thesis, as curated by CanopyBoulder.

-

The tool then uses a data-driven algorithm to define compatibility as well as a match score. The higher the score, the higher the potential this deal is a good fit for you and your team.

This data-driven toolkit is designed to empower cannabis investors to define their investor thesis and focus on the companies that make the most sense for their specific worldview.

Overall, there is no question that data-driven investors (much like data-driven companies) will quickly dominate the market. In addition to saving investors time, energy, and money in the short-term, the data toolkit will also get smarter over time, figuring out what worked and what didn’t work, and applying those lessons to future potential deals.

Our goal at CanopyBoulder is to help develop this industry rapidly, sustainably and profitability. We work to support those cannabis entrepreneurs and investors who will be the architects of this new industry. And the developer of this tool, Cannabis Big Data, shares our sentiment, which is why they are offering this tool for free. Forever. So that, as this industry continues to grow, we can continue to act as a data-driven connector for entrepreneurs and investors alike.

About Cannabis Big Data

Cannabis Big Data is a data toolkit for licensed and ancillary cannabis businesses. Their software connects the data dots by plugging into any data source (seed to sale, point of sale, accounting, spreadsheets, and much more) and organizing that information into easy, intuitive, and actionable insights. If you're curious, you can book them for a free data consultation here: https://cannabisbigdata.co/data-consultation/