The Marine Corps has a saying that goes something like this – it’s more important to make a decision at the right time than it is to make the right decision. The reason for this is simply that the pace of military operations requires decisions to be made quickly despite uncertainty. Delaying, even for what seems like a good reason, is more problematic than making an incorrect decision. Investing decisions are also more sensitive to time than to being right or wrong. In other words, it’s better to be in a bull market than to miss it because you couldn’t make a decision on where to invest.

The cannabis industry is experiencing a hidden bull market. Hidden from public market investors because the companies can’t list on the US exchanges. Hidden from investors because they live in states where cannabis isn’t legal yet. Hidden from high net worth individuals because their wealth managers don’t fully understand or embrace the opportunities yet. Now, before the market sees the opportunity, is the time to place bets on cannabis ventures. The details of the future are uncertain; however, the general trend is towards a multi-billion-dollar legalized market.

Cannabis is slowly being legalized around the world, starting with California in 1996 and progressing through to the first national recreational market, Canada in 2018. That’s an 18-year period, almost a generation. Our job as investors is to understand the timing of the market and specific companies within the market.

I spent the last four years evaluating and making investments in and around the legal cannabis markets. While managing $13MM in assets, I’ve learned a few things about timing and how cannabis markets develop within a state. I’ll dive into the data on two of the biggest markets, Colorado and Washington, to showcase some key points.

Colorado legalized medical marijuana in 2006 and recreational marijuana in 2012, a gap of only 6 years (although another two years passed before commerce commenced). So how do we time when to make an investment?

First, we look at the demographic and cultural data. How many people approve of cannabis legalization? What does the regulatory structure look like? How many “good” data points are there for regulators and law enforcement to create the necessary framework for a well-regulated market?

Often these questions are overlooked by investors reading the latest article in the news about a “billion-dollar company” making some splashy headline. The real questions relate to daily behaviors of consumers and companies. How much money is really changing hands?

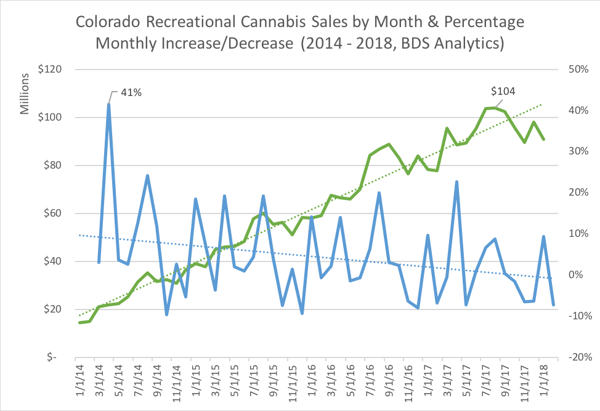

Colorado, for example, created a $1 billion industry from 2014 to 2017. Three years from $0 to $1 billion, and more specifically 30 months starting with $14MM in January 2014 and topping $83MM in July 2016, per BDS Analytics.

Here’s what that data looks like:

Data from BDS Analytics, April 2018

Some interesting elements emerge as we look at this data. For example, there is a periodic surge in growth occurring every few months with an average growth rate of about 20% on the “good” months followed by a reset with negative growth for a month or two. Part of this is explained by the seasonality of the Colorado market, note the slowdown in the fall of each year, after the summer rush but before the winter ski season.

Another interesting point is when the market crossed certainly revenue thresholds, namely the $100MM (January ’14), $500MM (March ’15), and $1B (July ’16) annual recurring revenue marks.

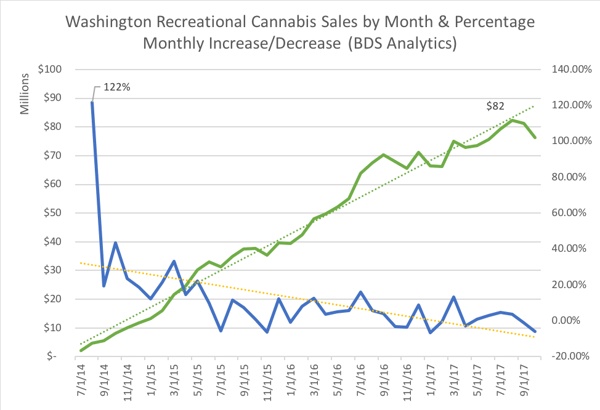

Colorado serves as a great example of a well-regulated market following a laissez-faire economic approach. Other states, like Washington, used a more heavily regulated approach and we can see the difference here:

Data from BDS Analytics, April 2018

Growth in Washington is a bit more consistent albeit at a slower overall rate. Additionally, we don’t necessarily see the same seasonal trends, perhaps because Washington has a more consistent buying population. Again, we note that the major milestones of $100MM, $500MM, and $1B in annual revenues take some time to develop: 4 months, 21 months and 38 months, respectively.

What can we, as investors, learn from this analysis? First, let’s keep in mind that the market is certainly there. Sales are booming and we’re seeing terrific revenue increases. Second, let’s temper that excitement with the reality of business. It takes time to make money. Developing a billion-dollar industry is NOT an overnight initiative even with a product like cannabis.

While there are many factors to consider when investing in a particular company or industry, timing is one of the most overlooked but crucial aspects. As my co-founder Patrick Rea often says, “the cannabis industry will never be smaller than it is today.”

At CanopyVentures, we focus on getting into a market at the right time, finding good teams, and helping them grow with the market. Diversification, expertise, and discipline allow us to provide exceptional returns to our investors by capitalizing on this once-in-a-lifetime opportunity. With these skills we work to select the best individual opportunities as part of a larger portfolio approach, topics we’ll cover in later discussions.